unemployment tax refund update october

4 million tax refunds for unemployment. The 10200 is the refund amount not the income exclusion level for single taxpayers.

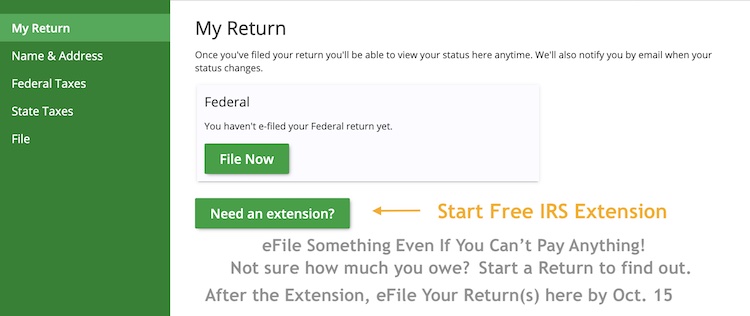

Prepare A Tax Return After An Extension By October 2022

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

. The federal tax code counts jobless benefits. IRS tax refunds to start in May for 10200 unemployment tax break. Thats bad for marine animals.

Climate change is speeding up sound in the ocean. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. 1 the irs announced it had sent about 430000 tax refunds to taxpayers who overpaid taxes on their unemployment in 2020.

IR-2021-212 November 1 2021. No other changes on the actual transcript yet though. Fast Company - April 1 2022 - By Talib Visram.

Same for me transcript date updated. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. To check the.

Anyone waiting for Unemployment Tax Refund seeing an as of date of Oct 4 2021. Heres what to know about paying taxes on unemployment benefits in tax year 2021 the return youll file in 2022. Thats the same data.

Waiting for your unemployment tax refund about 436000 returns are stuck in the irs system. Some of the payments are possibly related to 2020 unemployment compensation adjustments whereby the IRS excluded up to 10200 from taxable calculations. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

I got my unemployment refund on Sunday October 3rd yes on a freaking Sunday of all days. The IRS efforts to correct unemployment compensation overpayments will help most of the affected. 24 and runs through April 18.

Friday october 15 is approaching why your tax refunds are coming late. The IRS just confirmed yes. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

On thursday september 9 th the minnesota department of revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of september 13 th. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The IRS plans to send another tranche by the end of the year.

Some of the payments are possibly related to 2020 unemployment compensation adjustments whereby the IRS excluded up to 10200 from taxable calculations. A quick update on irs unemployment tax refunds today. But the work wasnt finished.

Of course the IRS also had traditional tax refunds to complete. What to know. September nor October - but on November 1.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Thousands of taxpayers may still be waiting for a. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption.

Overall the IRS says unprocessed individual tax year 2020 returns included those with errors. Are you still waiting for the IRS to return the taxes you paid on your 2020 unemployment benefits. How to check your irs transcript for clues.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. IR-2021-159 July 28 2021. 22 2022 Published 742 am.

The Nakagin Capsule Tower one of the worlds weirdest and most wonderful buildings will be demolished. As of October 2 the IRS had 28 million unprocessed amended individual tax returns Forms 1040-X. If so I have a quick update.

Officials said in a news release that the IRS. Heres what you need to know. They will go out as the IRS continues to process 2020 tax returns and recalculate returns that were already processed earlier in the year.

By July the IRS said it had paid out more than 87 million unemployment compensation refunds worth over 10 billion. The current processing time frame for these is 20 weeks up from the usual 16 weeks. The IRS is now concentrating on more complex returns continuing this process into 2022.

They fully paid and paid their state unemployment taxes on time. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment. The Department of Labor has not designated their state as a credit.

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. The IRS has already sent out 87 million. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

October 12 2021. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon.

A blog post from the National. To date the IRS has issued over 117 million refunds totaling 144billion. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

What are the unemployment tax refunds. By Anuradha Garg. And they are stating that my stimulus will be deposited on Thursday October 14th so roughly 11 days after receiving my unemployment tax refund I will receive my stimulus money that I have never received ever.

Thankfully the IRS has a plan for addressing returns that didnt account for that change. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

Those changesauthorized with the. Tax season started Jan. They are still issuing those refunds.

The IRS says 62million tax returns from 2020 remain unprocessed.

Resume Janine J9 Micheletti Resume Examples Job Resume Examples Good Resume Examples

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

October 15th Is Your Last Chance To File If You Requested An Extension Taxes Tips Tax Deadline Tips Cards Against Humanity

Received A Confusing Tax Letter Here S What Experts Say You Should Do

Bitcointe On Twitter Brave Browser Blocking Websites Browser

Millions Still Due 2020 Tax Refunds As October 15 Extension Deadline Nears

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Learnerships Agreement Tax Allowance Incentivising Your Employment Strategy Sa Institute Of Taxation

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Prepare A Tax Return After An Extension By October 2022

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Tax Prep Checklist One Though Mother Blog Family Binder Money Planner Tax Prep Checklist

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca